I can’t imagine having more empathetic bosses

Glenn shares how flexible working arrangements and support from his managers enables him to continue working whilst prioritising his wife Helen's care.

We know how hard it is when you, or someone you care for, lives with a diagnosis of dementia. And if you or someone you love has a diagnosis or is suspected to have dementia, it’s natural to worry about how you’ll cope, now and in the future.

But you’re not alone. On this page, you’ll find information on the legal terms you might encounter when you care for someone with dementia, advice on the financial benefits that you may be able to claim, and details of services and organisations that can support you.

We know that getting a dementia diagnosis can sometimes make you feel overwhelmed. Many people find that planning ahead for the future can help them feel more assured.

If you have a dementia diagnosis, or are caring for someone who does, you could be entitled to a number of benefits. Use the online Benefits Calculators to see the benefits you, or the person you care for, might be entitled to.

A benefit paid by the UK government to people of state pension age or older who are physically and/or mentally disabled.

You can claim it if your ability to keep safe or look after your own personal care is affected by physical and/or mental illness or disability.

You do not have to have someone caring for you in order to claim.

There are two weekly rates:

Claiming Attendance Allowance will not reduce any other benefits you receive, and it is tax-free. The other benefits you get may increase if you get Attendance Allowance. You could get extra Pension Credit, Housing Benefit or Council Tax Reduction if you get Attendance Allowance (Housing Benefit is being replaced by Universal Credit. Please read on for more information). Successful claims can be backdated to when you first applied.

Download a claim form or call 0800 731 0122 Monday to Friday, 8am to 3.30pm.

A UK government payment to the carer of someone who receives other benefits, like Attendance Allowance, Personal Independence Payment, or Disability Living Allowance.

You need to:

You could receive £83.30 a week. Keep in mind that the person being cared for may lose some of their benefits if their carer receives this allowance. Find out more about which benefits could be affected.

Call the Carer’s Allowance Unit on 0800 731 0297 between 10am and 2pm, Monday to Friday, or make a claim online.

Council Tax is a fee local authorities charge to people living in residential properties to help meet the cost of local services. Certain reductions on the charge are available for some people.

If a person with dementia is entitled to receive either Attendance Allowance, Personal Independence Payment, or Disability Living Allowance at the middle or higher rate, they should be exempt from paying Council Tax in England, Wales and Scotland.

Also, some carers do not have to pay Council Tax if they are living with and caring for a person with dementia who gets the higher rate of Attendance Allowance or Personal Independence Payment.

If a person with dementia lives in a private home with someone else, the Council Tax should be reduced by 25%. If the person with dementia lives alone, they are exempt from paying Council Tax.

How do I apply?

Call your local Council Tax department and ask for a form for ‘Council Tax discount because of mental impairment’.

ESA is a UK government benefit paid to people whose illness or disability affects their ability to work. It is being replaced by a benefit called Universal Credit.

You need to be:

You might be transferred from Incapacity Benefit to ESA and won’t be expected to return to work.

You’ll get a pre-assessment rate of between £72.90 and £74.70 when you first claim. Then, after 13 weeks, you can receive up to £140.55 a week.

Call the Universal Credit helpline on 0800 328 5644 between 8am and 6pm, Monday to Friday.

ESA is being replaced by a benefit called Universal Credit. Universal Credit is being introduced in stages throughout the UK. Everyone who claims one or more of the six benefits that will be replaced by Universal Credit will be moved across by September 2024. To find out if you are eligible to claim Universal Credit or ESA.

A benefit paid by the UK government which helps with some of the extra costs caused by long-term illness or a disability.

You must be aged 16 or over and usually have not reached State Pension age to claim. You must also have a health condition or disability where you have difficulties with daily living or getting around (or both).

PIP is tax-free and you can get it whether you are in or out of work.

You could get between £73.90 and £187.45 a week, depending on how your condition affects you.

Call the Department of Work and Pensions PIP claims on 0800 917 2222 between 8am and 5pm, Monday to Friday.

A personal health budget is an amount of money to support your health and wellbeing needs, which is planned and agreed between you (or someone who represents you), and your local NHS team. It allows you to manage your healthcare and support needs such as treatments, equipment and personal care, in a way that suits you.

The right to have a personal health budget only applies to adults currently in receipt of NHS Continuing Healthcare Funding, but local NHS organisations are free to offer personal health budgets to other people on a voluntary basis if they think an individual will benefit from it.

Talk to the local NHS team that helps you most often with your care.

Local authorities have a legal responsibility to ensure that your care needs are met. A personal budget is an amount of money from a local authority to help people to manage their care in a way that suits them. If they agree to pay for some or all of your care needs, the local authority must also offer a choice of how to meet your needs. The aim of personal budgets is to give people greater choice over the care and support they receive.

A person must have been assessed as requiring services in order to receive a personal budget, and the payment must be used to purchase the services that the person needs. Payments may be made to the carers and to people with dementia.

You can request information about a personal budget by contacting your Social Services department and asking for a Needs Assessment or a Carer’s Assessment.

Once a care and support plan has been put in place, it can be managed in different ways:

A personal budget is for your social care needs, while a personal health budget is for your NHS healthcare needs.

Personal health budgets and personal budgets may be joined together into one package of care.

Provision of care in the UK is the joint responsibility of the NHS, which provides healthcare, and the local authority Social Services which provides social and personal care. Services that the NHS provides are mostly free. But you may have to pay for all or some of the services that are arranged by your local authority Social Services, depending on your income and the amount of your savings.

Any decision as to whose responsibility it is to provide care can have significant financial consequences. A booklet produced by the Alzheimer’s Society, called ‘When does the NHS pay for care?’ offers guidance on eligibility. It explains what NHS continuing healthcare is, how you might be able to get it, and what to do if your request is turned down.

If you’ve been diagnosed with dementia, you might want to think about choosing someone to make health, welfare and/or financial decisions for you in the future when you may not have the capacity to make them for yourself. The person you choose is called an attorney and is appointed by a formal document called a Lasting Power of Attorney (LPA).

There are two types of LPA:

Contact your solicitor to make an LPA or use a special form from the Office of the Public Guardian. You can call the Office of the Public Guardian on 0300 456 0300, between 9.30am and 5pm, Monday, Tuesday, Thursday, Friday, and between 10am and 5pm on Wednesdays. You can also fill out the form online.

If you don’t have a solicitor and have questions about Lasting Power of Attorney, contact Allied Services Trust, a charity providing education, assistance and support to help individuals prepare for possible incapacity. Call Allied Services Trust on 01590 644073.

An LPA is only valid in England and Wales. People in Northern Ireland can contact the Office of Care and Protection for advice on 0300 200 7812.

People in Scotland can contact the Office of the Public Guardian (Scotland) on 01324 678398.

EPAs have been replaced by Lasting Power of Attorneys. However, if you made and signed an EPA before 1st October 2007, it’s still valid. An EPA only covers decisions about your property and financial affairs. That means an attorney does not have power under an EPA to make decisions about your health and welfare.

While you are able to make your own decisions, your attorney can use an EPA to help manage your finances without registering it with the Office of the Public Guardian. When you become unable to make your own decisions relating to financial and property matters, the EPA must be registered with the Office of the Public Guardian before your attorney can take any further action on your behalf.

Call the Office of the Public Guardian on 0300 456 0300, between 9.30am and 5pm, Monday, Tuesday, Thursday, Friday and between 10am and 5pm on Wednesdays.

The Court of Protection might be able to help you if you’re caring for someone with dementia. It deals with issues relating to people who lack capacity to make decisions for themselves.

Under the Mental Capacity Act, the court has the power to make:

The court can appoint a ‘deputy’ to take control of someone’s affairs:

Call The Court of Protection on 0300 456 4600 between 9.30am and 4.30 pm, Monday to Friday.

Our free, confidential Dementia Helpline is staffed by our dementia specialist Admiral Nurses who provide information, advice and support with any aspect of dementia.

Glenn shares how flexible working arrangements and support from his managers enables him to continue working whilst prioritising his wife Helen's care.

Will shares how his mum's diagnosis impacted the family and highlights the importance of advocating for young carers.

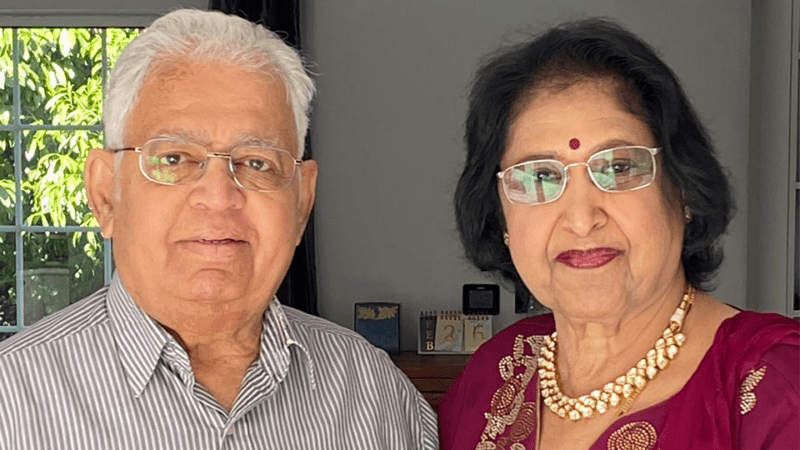

Pratibha shares her experience of caring for her late husband, Narayan Gopala, who lived with vascular dementia and died in 2024.